life insurance face amount issued

Typically term life insurance is issued in 5 year increments such as 10 15 20 or 30 years. The face value or the face amount is materialized in the insurance policy when issued and established.

Life Insurance Claim Process And Required Documents Policyx Com

Data is current as of 4-30-11.

/GettyImages-1134608493-a72c93c4adc34ee3b5a1c6e54dffa379.jpg)

. Face amount life insurance definition industrial life insurance face amounts face amount of policy face amount meaning life insurance face value what is face amount face amount vs. But it is also possible to get a term life insurance policy tailored to your specific needs. The face value or face amount of a life insurance policy is established when the policy is issued.

The way they do this is by referring to the Face Amount of the policy. The gross premium G for a fully discrete whole life insurance with face amount of 1000 issued to 40 is determined using the equivalence principle. I G 35797 ii 1000P40.

Most of these policies have small face values. On the contrary the death benefit is the. The face amount is the initial amount of money stated on the life insurance application when you first buy the policy and is intended to be paid as a death benefit to your.

What Dave Ramsey Says About The Difference Between Term and Whole Life Insurance. Of all life insurance in force in the United States at year-end 2020 Table 71. For example if you buy a 100000 life.

The exact amount of death benefit acquired mentions the total amount and. In 2018 the average face amount of individual life insurance policies purchased in the United States was about 168 thousand US. Maximum face amounts for Jenny Lifes Simplified Issue Term life insurance depend on the age at which you buy a policy.

Insurance companies sell guaranteed issue policies without medical underwriting. Generally the larger the face value of your policy the. Ad Know the Difference Between Term Life and Whole Life Insurance and Learn Which is Better.

Life Insurance Face Amount Sep 2022. All programs are closed to new issues except for Service. Typically purchased through life insurance agents this insurance is issued under individual policies with face.

Up to 1 million. The face amount is stated in the contract or application. Its the amount of death benefit purchased which indicates the amount of.

If you earn 50000 a year that could mean choosing a policy with a face value of 500000 or 750000. Life Insurance in the United States. In other words the Face Amount of a life insurance policy is the amount of insurance that will be.

The face amount or face value of a life insurance policy is the amount of money an insurer will pay out to beneficiaries if the policyholder passes away. But as the cash value of the policy changes over time it can alter the total death benefit either above or. The face amount is the purchased amount at the beginning of life insurance.

Life Insurance Face Amount - If you are looking for an online quote provider then we have lots of options waiting for you. There are limitations to those plans though. Face value of insurance for each administered life insurance program listed by state.

Available for insured ages 0-60. Waiver of Specified Premium. Face Decrease Monthaversary.

The face amount is the initial death benefit on a life insurance policy.

/dotdash-variable_universal-Final-66a32d4c8d84418ab1271e02d73d2a4b.jpg)

Variable Life Vs Variable Universal What S The Difference

Guide To Buying Life Insurance For Parents Elderly Burial

:max_bytes(150000):strip_icc()/dotdash-090816-cash-value-vs-surrender-value-what-difference-final-b2df392375e34caf9eac4e7bc2648283.jpg)

Cash Value Vs Surrender Value What S The Difference

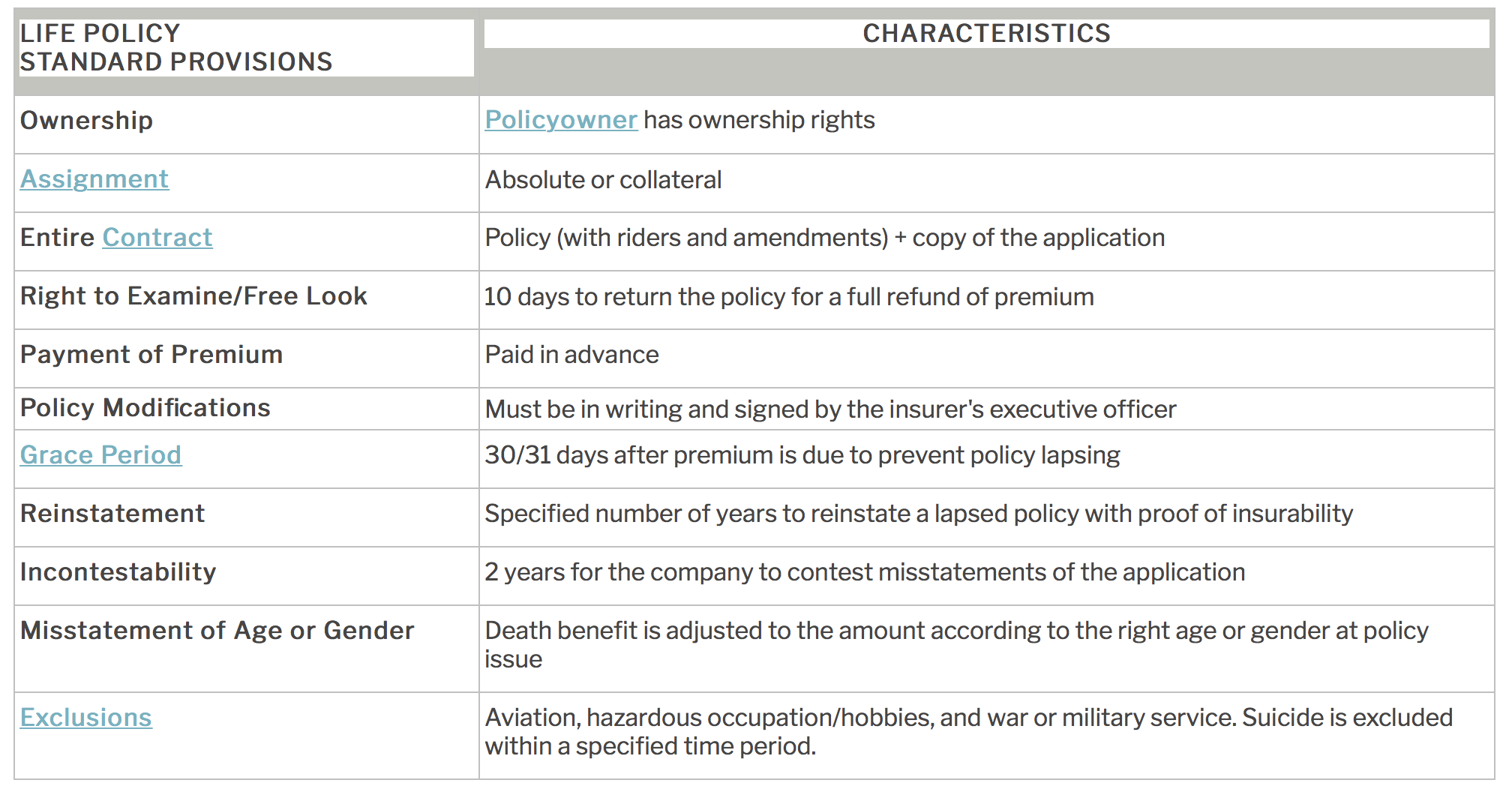

Policy Provisions Options And Other Features Flashcards Chegg Com

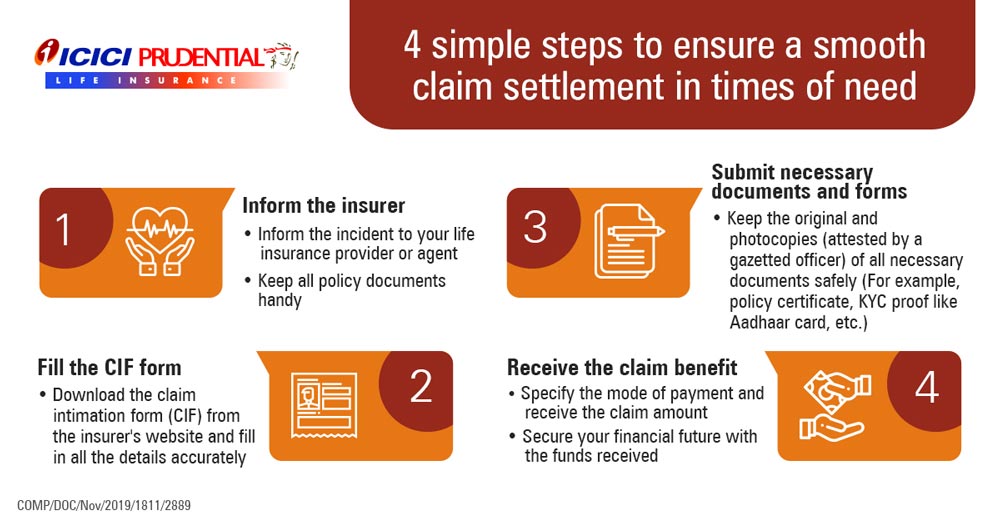

What Is Life Insurance Life Insurance Definition Meaning Icici Prulife

:max_bytes(150000):strip_icc()/lifeinsurance-v32-8e01fd19793a49699e47973cfdf98f3d.png)

Life Insurance Guide To Policies And Companies

How To Find Out If Someone Has Life Insurance Unclaimed Policies

/dotdash-090816-cash-value-vs-surrender-value-what-difference-final-b2df392375e34caf9eac4e7bc2648283.jpg)

Cash Value Vs Surrender Value What S The Difference

What Is Whole Life Insurance And How Does It Work Lincoln Heritage

9 Best Life Insurance Companies Of September 2022 Money

What Should I Be Looking For In Life Insurance Life Insurance Marketing Ideas Life Insurance Facts Life Insurance Marketing

How Hybrid Life Insurance Pays For Long Term Care Forbes Advisor

The 7 Types Of Life Insurance Policies What S The Best One For You

How Whole Life Insurance Works Permanent Life Insurance Whole Life Insurance Life Insurance Policy

/lifeinsurance-Final-c0a16b859a4c4d9486ef3636d349fd89.png)